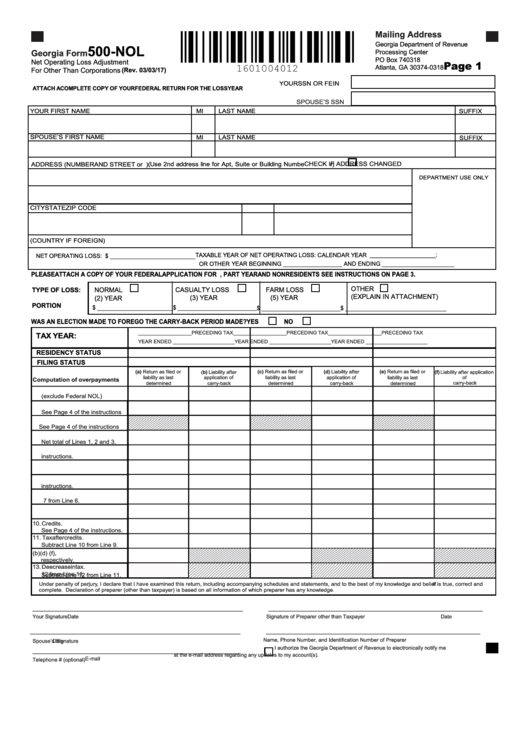

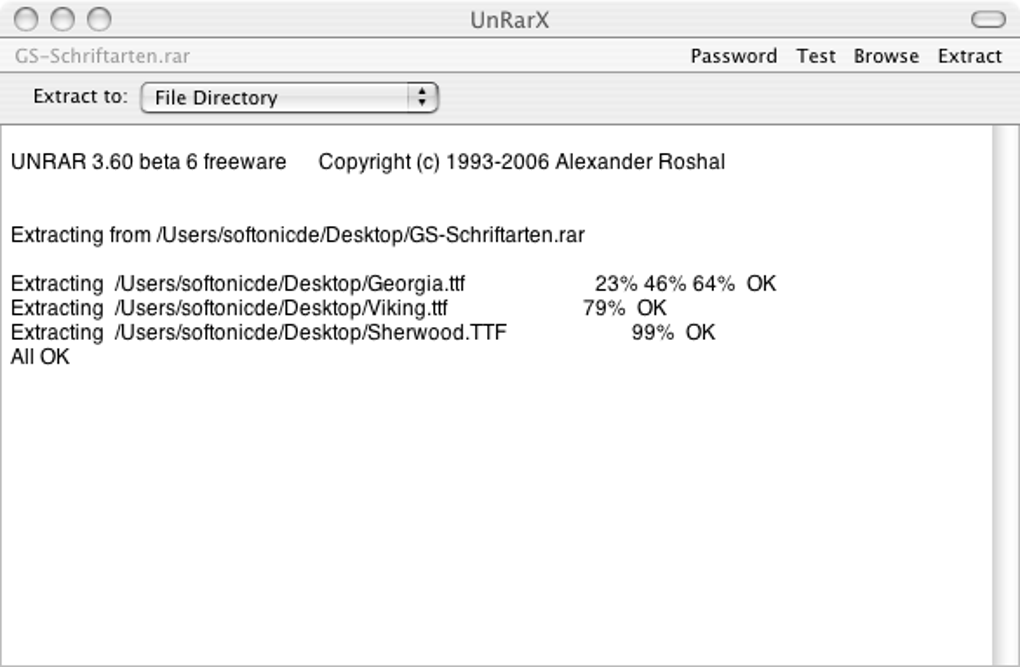

Georgia Form 500 For Mac

Estimated Quarterly Tax Return 500ES INDIVIDUAL/FIDUCIARYDO NOT MA IL! PLEAS E State of Georgia Department of Revenue KEEP THESE INSTRUCTIONS AND WORKSHEET WITH YOUR RECORDS Instructions 1. Download (free) the latest version of Adobe Reader. Adobe.com/products/acrobat/readstep2.html 2. Complete the worksheet below to automatically create your payment voucher.

Click the “Print” button to print a completed 500 ES Individual/Fiduciary payment voucher. Cut the payment voucher along the dotted line and mail the voucher and your payment only to the address on the voucher. DO NOT fold, staple or paper clip items being mailed. DO NOT mail in the worksheet, keep this for your records. 500-ES Worksheet for Individual/Fiduciary 2.

Spouse’s SSN: 1. Taxpayer's SSN: 3.

Individual or Fiduciary Name: 4. Street Address Line 1: 5. Street Address Line 2: 6. Please Select Tax Type of Return. Check If Address Change. Calendar Year or Fiscal Year Ending: Select 12. Due Date.

Amount Paid. Print Clear 8. Zip: - INSTRUCTIONS FOR INDIVIDUAL AND FIDUCIARIES ESTIMATED TAX (500ES) WHO MUST FILE ESTIMATED TAX.

Each individual or fiduciary subject to Georgia income tax who reasonably expects to have gross income during the year which exceeds (1) personal exemption, plus (2) credit for dependents, plus (3) estimated deductions, plus (4) $1,000 o f income not subject to withholding. Estimated tax is not required if, under an agreement between the employer and the employee, additional tax is withheld to cover income that normally would require estimated tax to be filed. Individuals whose gross income from farming or fishing is at least two thirds of the total gross income from all sources may: (a) file as other taxpayers or (b) file their return by March 1 and pay the full amount of tax due by that date. Fiduciaries shall not be required to pay estimated tax with respect to any taxable year ending before the date two years after the date of the decedent’s death in the case of: 1. The estate of such decedent; or 2. A testamentary trust as defined in IRC Section 6654(l)(2)(B).

PURPOSE OF ESTIMATED TAX. The purpose is to enable taxpayers having income not subject to withholding to currently pay their income tax. Taxpayers are also required to file an annual return claiming credit thereon for amounts paid or credited to their estimated tax.

PAYMENT OF ESTIMATED TAX. Payment in full of your estimated tax may be made with the first required installment or in equal installments during this year on or before April 15, June 15, September 15, and the following January 15.

Fiscal year filers should adjust the dates accordingly. If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday. Please include your Social Security number or FEIN on your check. HOW TO ESTIMATE YOUR TAX. A schedule for computing your estimated tax and the tax rate schedules are listed in the Tax Booklet. Failure to comply with the provisions of this law relative to underpayment of installments may result in the assessment of additional charges as a penalty.

Willful failure to pay estimated tax will constitute a misdemeanor. STANDARD DEDUCTION. Single and head of household. $2,300 Married filing jointly. $3,000 Married filing separately.$1,500 Additional Deduction: Age 65 or older. $1,300 Blind.$1,300 WHEN AND WHERE TO FILE.

Estimated tax required from persons not regarded as farmers or fishermen shall be filed on or before April 15 of the taxable year, except if the above requirements are first met on or after April 1 and before June 1, estimated tax must be filed by June 15; on or after June 1 but before September 1, by September 15; and on or after September 1, by January 15 of the following year. Individuals filing on a fiscal year basis ending after December 31 must file on corresponding dates.

Make check or money order payable to: “Georgia Department of Revenue” Payment should be mailed to: Processing Center Georgia Department of Revenue PO Box 740319 Atlanta, Georgia You may also pay estimated tax with a credit card. Visit our website at dor.georgia.gov for more information. HOW TO COMPLETE FORM 500 ES. Complete the name and address field located on the upper right side of coupon. Calculate your estimated tax using the schedule in the tax booklet.

Line 15 is your estimated tax for the year. Divide Line 15 by the number of quarters of liability (see “When and Where to File” above) to compute the amount to be submitted quarterly.

Enter this amount on Form 500 ES and submit to the Georgia Department of Revenue. EXEMPTION AMOUNT FOR TAX YEAR 2018 Personal Exemption for self and spouse if married (each).$3,700 Personal Exemption for self if not married.$2,700 Dependent Exemption.$3,000 Maximum Retirement Income Exclusion: If age 62-64 or less than 62 and permanently disabled.$35,000 If age 65 or older.$65,000 For additional information concerning Individual forms please call: 1-877-423-6711. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia. These additional deductions are for you and your spouse only if the standard deduction is used. These amounts are standard regardless of income.

PLEASE DO NOT STAPLE. PLEASE REMOVE ALL ATTACHED CHECK STUBS. Cut along dotted line 500 ES Individual or Fiduciary Name and Address: (Rev. 06/22/17) Individual and Fiduciary Estimated Tax Payment Voucher Calendar Year or Fiscal Year Ending Taxpayer’s SSN or Fiduciary FEIN TYPE OF RETURN: Spouse’s SSN Tax Year Quarter Due Date Vendor Code 040 0 PLEASE DO NOT STAPLE. REMOVE ALL CHECK STUBS. PROCESSING CENTER GEORGIA DEPARTMENT OF REVENUE PO BOX 740319 ATLANTA GA 500000Seec000000NaN If your name and address is incorrect, mark the change of address box and make the change in the box below. Address Change Amount Paid $ Extracted from PDF file, last modified October 2004.

Form 500-ES contains an estimated tax worksheet and a voucher for mailing quarterly estimated income tax payments. We last updated the Estimated Quarterly Tax Return in January 2018, so this is the latest version of Form 500-ES, fully updated for tax year 2017. You can download or print current or of Form 500-ES directly from TaxFormFinder.

You can print other. Other Georgia Individual Income Tax Forms: TaxFormFinder has an additional that you may need, plus all. Form Code Form Name Form 500 Form 500-EZ Tax Return Form 500-ES Estimated Form IT-511 Form IT-560 Extension Form Sources: Georgia usually releases forms for the current tax year between January and April. We last updated Georgia Form 500-ES from the Department of Revenue in January 2018. Original Form PDF is.

Georgia Income Tax Forms at. Georgia Department of Revenue at Form 500-ES is a Georgia Individual Income Tax form. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc) are often required to make estimated tax payments on a quarterly basis. Failure to make correct estimated payments can result in interest or penalties. About the Individual Income Tax The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms!

Historical Past-Year Versions of Georgia Form 500-ES.

Individual Income Tax Returns GA500DUALTT-IVTW-CBEX-WVRB-GSCU PRINT PLEASE, USE THE BLUE PRINT BUTTON TO PRINT THIS FORM. 500 Georgia Form (Rev. 06/22/17) Individual Income Tax Return Georgia Department of Revenue Page HELP RESET 1 2017 (Approved web version) Fiscal Year Beginning Fiscal Year verEnding 1.

YOUR DRIVER’S LICENSE/STATE ID YOUR FIRST NAME MI STATE ISSUED G A YOUR SOCIAL SECURITY NUMBER LAST NAME SUFFIX SPOUSE’S FIRST NAME MI SPOUSE’S SOCIAL SECURITY NUMBER DEPARTMENT USE ONLY LAST NAME 2. SUFFIX ADDRESS (NUMBER AND STREET or P.O. BOX) (Use 2nd address line for Apt, Suite or Building Number) CITY (Please insert a space if the city has multiple names) STATE CHECK IF ADDRESS HAS CHANGED ZIP CODE (COUNTRY IF FOREIGN) Residency Status 4. Enter your Residency Status with the appropriate number.

FULL- YEAR RESIDENT 2. PART- YEAR RESIDENT TO 4. NONRESIDENT Part-Year Residents and Nonresidents must omit Lines 9 thru 14 and use Form 500 Schedule 3. Filing Status 5. Enter Filing Status with appropriate letter (See I T - 5 1 1 Tax Booklet). B.Married filing joint C.Married filing separate(Spouse’s social security number must be entered above) D. Head of Household or Qualifying Widow(er) 6.

Number of exemptions (Check appropriate box(es) and enter total in 6c.) 6a. Spouse ALL PAGES (1-5) ARE REQUIRED FOR PROCESSING 6c. Georgia Form Page 500 Individual Income Tax Return Georgia Department of Revenue 2 2017 YOUR SOCIAL SECURITY NUMBER 7a. Number of Dependents (Enter details on Line 7c., and DO NOT include yourself or your spouse). Enter the total number of exemptions and dependents (Add Lines 6c and 7a).

Dependents (If you have more than 5 dependents, attach a list of additional dependents) First Name, MI. Last Name Social Security Number Relationship to You SELECT First Name, MI. Last Name Social Security Number Relationship to You SELECT First Name, MI. Last Name Social Security Number Relationship to You SELECT First Name, MI. Last Name Social Security Number Relationship to You SELECT First Name, MI. Last Name Social Security Number Relationship to You SELECT INCOME COMPUTATIONS If amount on line 8, 9, 10, 13 or 15 is negative, use the minus sign (-). Example -3,456.

Federal adjusted gross income (From Federal Form 1040,1040A or 1040 EZ). (Do not use FEDERAL TAXABLE INCOME) If the amount on Line 8 is $40,000 or more, or your gross income is less than your W-2s you must include a copy of your Federal Form 1040 Pages 1 and 2. Adjustments from Form 500 Schedule 1 (See IT-511 Tax Booklet ).

Georgia adjusted gross income (Net total of Line 8 and Line 9). ALL PAGES (1-5) ARE REQUIRED FOR PROCESSING. 00 Georgia Form Pag e 500 Individual Income Tax Return Georgia Department of Revenue 3 2017 YOUR SOCIAL SECURITY NUMBER 11.

Standard Deduction (Do not use FEDERAL STANDARD DEDUCTION). (See IT-511 Tax Booklet) b. Self: 65 or over? Spouse: 65 or over?

Total x 1,300=. Total Standard Deduction (Line 11a + Line 11b). Use EITHER Line 11c OR Line 12c (Do not write on both lines) 12. Total Itemized Deductions used in computing Federal Taxable Income.

If you use itemized deductions, you must include Federal Schedule A a. Federal Itemized Deductions (Schedule A-Form 1040). Less adjustments: (See IT-511 Tax Booklet). Georgia Total Itemized Deductions. Subtract either Line 11c or Line 12c from Line 10; enter balance.

Enter the number from Line 6c. Multiply by $2,700 for filing status A or D or multiply by $3,700 for filing status B or C 14a. Enter the number from Line 7a.

Multiply by $3,000. Add Lines 14a. Enter total. Georgia taxable income (Line 13 less Line 14c or Schedule 3, Line 14). TAX TABLE Tax (Use Tax Table in the IT-511 Tax Booklet). Low Income Credit 17a. Other State(s) Tax Credit (Include a copy of the other state(s) return).

Credits used from IND-CR Summary Worksheet. Total Credits Used from Schedule 2 Georgia Tax Credits.

Total Credits Used (sum of Lines 17-20) cannot exceed Line 16. Balance (Line 16 less Line 21) if zero or less than zero, enter zero. Georgia Income Tax Withheld on Wages and 1099s. (Enter Tax Withheld Only and include W-2s and/or 1099s) 24. Other Georgia Income Tax Withheld. (Must include G2-A, G2-FL, G2-LP and/or G2-RP) 24. PLEASE COMPLETE INCOME STATEMENT DETAILS ON PAGE 4.

ALL PAGES (1-5) ARE REQUIRED FOR PROCESSING. 00 Georgia Form Page 500 Individual Income Tax Return Georgia Department of Revenue 2017 4 YOUR SOCIAL SECURITY NUMBER INCOME STATEMENT DETAILS Only enter income on which Georgia Tax was withheld. Enter W-2s, 1099s, and G2-As on Line 4 GA Wages/Income. For other income statements complete Line 4 using the income reported from Form G2-RP Line 12 or 13; Form G2-LP Line 11, or Form G2-FL enter zero. (INCOME STATEMENT A) 1.

(INCOME STATEMENT B) 1. WITHHOLDING TYPE: (INCOME STATEMENT C) 1. WITHHOLDING TYPE: WITHHOLDING TYPE: W-2s G2-A G2-LP W-2s G2-A G2-LP W-2s G2-A G2-LP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 3.

EMPLOYER/PAYER STATE WITHHOLDING ID 4. GA WAGES / INCOME 4. GA WAGES / INCOME 4. GA WAGES / INCOME 5. 00 GA TAX WITHHELD. 00 (INCOME STATEMENT D) 1. W-2s G2-A 1099s G2-FL 5.

GA TAX WITHHELD. 00 (INCOME STATEMENT E) 1. WITHHOLDING TYPE:. GA TAX WITHHELD.

00 (INCOME STATEMENT F) 1. WITHHOLDING TYPE: EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN WITHHOLDING TYPE: G2-LP W-2s G2-A G2-LP W-2s G2-A G2-LP G2-RP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) (FEIN SSN 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2.

EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 4. GA WAGES / INCOME 4. GA WAGES / INCOME 4. GA WAGES / INCOME 5. GA TAX WITHHELD.

GA TAX WITHHELD. 00 EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 5. GA TAX WITHHELD Please complete the Supplemental W-2 Income Statement if additional space is needed.

Estimated Tax paid for 2017 and Form IT-560. Total prepayment credits (Add Lines 23, 24 and 25). If Line 22 exceeds Line 26, subtract Line 26 from Line 22 and enter balance due. If Line 26 exceeds Line 22, subtract Line 22 from Line 26 and enter overpayment.

Amount to be credited to 2018 ESTIMATED TAX. Pages (1-5) are Required for Processing. 00 Georgia Form Page 500 Individual Income Tax Return Georgia Department of Revenue 2017 YOUR SOCIAL SECURITY NUMBER 30. Georgia Wildlife Conservation Fund (No gift of less than $1.00). Georgia Fund for Children and Elderly (No gift of less than $1.00).

Georgia Cancer Research Fund (No gift of less than $1.00). Georgia Land Conservation Program (No gift of less than $1.00). Georgia National Guard Foundation (No gift of less than $1.00). Dog & Cat Sterilization Fund (No gift of less than $1.00).

Saving the Cure Fund (No gift of less than $1.00). Realizing Educational Achievement Can Happen (REACH) Program. (No gift of less than $1.00) 37. Public Safety Memorial Grant (No gift of less than $1.00). 500 UET exception attached.

(If you owe) Add Lines 27, 30 thru 39 MAKE CHECK PAYABLE TO GEORGIA DEPARTMENT OF REVENUE. (If you are due a refund) Subtract the sum of Lines 29 thru 39 from Line 28 40. Form 500 UET (Estimated tax penalty) THIS IS YOUR REFUND. Direct Deposit (For U.S. Accounts Only) Type: Checking Savings. Routing Number Account Number If you do not enter Direct Deposit information or if you are a first time filer a paper check will be issued. (PAYMENT) PROCESSING CENTER GEORGIA DEPARTMENT OF REVENUE PO BOX 740399 ATLANTA, GA (REFUND and NO BALANCE DUE) PROCESSING CENTER GEORGIA DEPARTMENT OF REVENUE PO BOX 740380 ATLANTA, GA INCLUDE ALL ITEMS IN ENVELOPE, DO NOT STAPLE YOUR CHECK, W-2s, OTHER WITHHOLDING DOCUMENTS, OR TAX RETURN.

I/We declare under the penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer(s), this declaration is based on all information of which the preparer has knowledge. Georgia Public Revenue Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United States, free of any expense to the State of Georgia. Taxpayer’s Signature (Check box if deceased) Date Spouse’s Signature (Check box if deceased) Date Taxpayer’s Phone Number I authorize DOR to discuss this return with the named preparer. Preparer’s Phone Number Signature of Preparer Name of Preparer Other Than Taxpayer Preparer’s Firm Name Preparer’s FEIN Preparer’s SSN/PTIN/SIDN ALL PAGES (1-5) ARE REQUIRED FOR PROCESSING Page 1 Georgia Income Statement Details Supplemental W-2 Income Statement Georgia Department of Revenue 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER INCOME STATEMENT DETAILS nly enter o G Enter W-2s, 1099s, and G2-As on Line 4 GA Wages/Income. For other income statements complete Line 4 using the income reported from Form G2-RP Line 12 or 13; Form G2-LP Line 11, or for Form G2-FL enter zero.

(INCOME STATEMENT A) WITHHOLDING TYPE: 1. (INCOME STATEMENT B) WITHHOLDING TYPE: 1. (INCOME STATEMENT C) WITHHOLDING TYPE: W-2s G2-A G2-LP W-2s G2-A G2-LP W-2s G2-A G2-LP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER STATE WITHHOLDING ID 3.

EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 4. GA WAGES / INCOME 4.

GA WAGES / INCOME 4. GA WAGES / INCOME 5.

GA TAX WITHHELD 1. (INCOME STATEMENT D) WITHHOLDING TYPE:. GA TAX WITHHELD 1. 00 (INCOME STATEMENT E) WITHHOLDING TYPE: EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN.

GA TAX WITHHELD 1. 00 (INCOME STATEMENT F) WITHHOLDING TYPE: W-2s G2-A G2-LP W-2s G2-A G2-LP W-2s G2-A G2-LP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER STATE WITHHOLDING ID 3.

EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 4. GA WAGES / INCOME 4. GA WAGES / INCOME 4. GA WAGES / INCOME 5. GA TAX WITHHELD 1. (INCOME STATEMENT G) WITHHOLDING TYPE:.

GA TAX WITHHELD 1. 00 (INCOME STATEMENT H) WITHHOLDING TYPE: EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN. GA TAX WITHHELD 1. 00 (INCOME STATEMENT I) WITHHOLDING TYPE: W-2s G2-A G2-LP W-2s G2-A G2-LP W-2s G2-A G2-LP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 1099s G2-FL G2-RP 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2. EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 2.

EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 3. EMPLOYER/PAYER STATE WITHHOLDING ID 4. GA WAGES / INCOME 4. GA WAGES / INCOME 4.

GA WAGES / INCOME 5. GA TAX WITHHELD.

GA TAX WITHHELD. 00 EMPLOYER/PAYER FEDERAL ID NUMBER (FEIN) SSN 5. GA TAX WITHHELD. 00 Schedule 1 Page 1 500 Georgia Form (Rev. 06/22/17) Schedule 1 Adjustments to Income 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER SCHEDULE 1 ADJUSTMENTS to INCOME BASED on GEORGIA LAW (See IT-511 Booklet) ADDITIONS to INCOME 1.

Interest on Non-Georgia Municipal and State Bonds. Lump Sum Distributions. Federal deduction for income attributable to domestic production activities. (IRC Section 199) 3.

Net operating loss carryover deducted on Federal return. Other (Specify) 5. Total Additions (Enter sum of Lines 1-5 here). 00 SUBTRACTION from INCOME 7. Retirement Income Exclusion (See IT-511 Tax Booklet) Complete Schedule 1, page 2 if claiming Retirement Income Exclusion. Self: Date of Birth b. Spouse: Date of Birth Date of Disability: Date of Disability: Type of Disability: 7a.

00 Type of Disability: 8. Social Security Benefits (Taxable portion from Federal return). Path2College 529 Plan. Interest on United States Obligations (See IT-511 Tax Booklet ). Georgia Net Operating loss carryover from previous years (List only the amount used in 2017, see IT-511 Tax Booklet ). Other Adjustments (Specify) Adjustment Amount Adjustment Amount Adjustment Amount Adjustment Amount Total. Total Subtractions (Enter sum of Lines 7-12 here).

Net Adjustments (Line 6 less Line 13). Enter Net Total here and on Line 9 of Page 2 (+ or -) of Form 500 or Form 500X. 00 Schedule 1 Page 2 500 Georgia Form (Rev. 06/22/17) Schedule 1 Adjustments to Income 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER SCHEDULE 1 RETIREMENT INCOME EXCLUSION Social security and railroad retirement paid by the Railroad Retirement Board, exempt interest, or other income that is not taxable to Georgia should not be included in the retirement income exclusion calculation. Income or losses should be allocated to the person who owns the item.

If any item is held jointly, the income or loss should be allocated to each taxpayer at 50%. Part-year residents and nonresidents must prorate the retirement income exclusion. The earned income portion and the unearned income portion must be separately prorated. The earned income portion shall be prorated using the ratio of Georgia source earned income to total earned income computed as if the taxpayer were a resident of Georgia for the entire year. The unearned portion shall be prorated using the ratio of Georgia source unearned retirement income to total unearned retirement income computed as if the taxpayer were a resident of Georgia for the entire year.Retirement income does not include income received directly or indirectly from lotteries, gambling, illegal sources or similar income. Rental, Royalty or Partnership income that is subject to FICA tax or Self employment tax should be included on line 2 not line 13. Trade or business income from an S Corp in which the taxpayer or their spouse materially participated should be included on line 2 not line 13.

(TAXPAYER) 1. Salary and wages. Other Earned Income (Losses). Total Earned Income. Maximum Earned Income.

Smaller of Line 3 or 4; if zero or less, enter zero. Interest Income. Dividend Income.

Capital Gains (Losses). Other Income (Losses). Taxable IRA Distributions. Taxable Pensions. Rental, Royalty, Partnership, S Corp, etc.

Income (Losses). Total of Lines 6 through 13; if zero or less, enter zero. Add Lines 5 and 14.

Maximum Allowable Exclusion, if age 62-64 or less than age 62 and permanently disabled enter $35,000, or if age 65 or older enter $65,000. Smaller of Lines 15 and 16; enter here and on Form 500, Schedule 1, Lines 7A & B. 4 0 (SPOUSE) 0. 00 Schedule 2 Page 1 500 Georgia Form (Rev. 06/22/17) Schedule 2 Georgia Tax Credits 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER SCHEDULE 2 GEORGIA TAX CREDIT USAGE AND CARRYOVER See IT-511 Tax Booklet for Instructions For the credit generated this year (series 100), list the Company/Individual Name, FEIN/SSN, Credit Certificate Number, if applicable, and% of credit (purchased credits should also be included).

If the credit originated with this taxpayer, enter this taxpayer’s name and FEIN/SSN below and 100% for the percentage. First Credit Code. Credit remaining from previous years (If from a business, do not include amounts elected to be applied to withholding).

Company/Individual Name Credit Certificate # SELECT 1. 00 2.% of Credit FEIN/SSN Credit Generated in 2017 4. Company/Individual Name Credit Certificate #% of Credit FEIN/SSN Credit Generated in 2017 5. Company/Individual Name Credit Certificate # FEIN/SSN Credit Generated in 2017 6. Credit Used in 2017. Potential carryover to 2018 (Line 6 less Lines 7 and 8). Second Credit Code.

Credit remaining from previous years (If from a business, do not include amounts elected to be applied to withholding). Company/Individual Name% of Credit FEIN/SSN Credit Generated in 2017 13.

Company/Individual Name Credit Certificate #. 00% of Credit 6. Total available credit for 2017 (sum of Lines 2 through 5). Enter the amount of the credit sold (Conservation Tax Credits, Film Tax Credits and certain Historic Rehabilitation Tax Credits).

Credit Certificate #. 00% of Credit FEIN/SSN Credit Generated in 2017. 00 Schedule 2 Page 2 500 Georgia Form (Rev.

06/22/17) Schedule 2 Georgia Tax Credits 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER SCHEDULE 2 GEORGIA TAX CREDIT USAGE AND CARRYOVER (continued) 14. Company/Individual Name% of Credit Credit Certificate # Credit Generated in 2017 FEIN/SSN 15. Total available credit for 2017 (sum of Lines 11 through 14). Enter the amount of the credit sold (Conservation Tax Credits, Film Tax Credits and certain Historic Rehabilitation Tax Credits).

Credit Used in 2017. Potential carryover to 2018 (Line 15 less Lines 16 and 17). Third Credit Code. Credit remaining from previous years (If from a business, do not include 20. Amounts elected to be applied to withholding).

Company/Individual Name Credit Certificate #. 00% of Credit FEIN/SSN Credit Generated in 2017 22. Company/Individual Name. 00% of Credit Credit Certificate # FEIN/SSN Credit Generated in 2017 23. Company/Individual Name.

00% of Credit Credit Certificate # FEIN/SSN Credit Generated in 2017 24. Total available credit for 2017 (sum of Lines 20 through 23). Enter the amount of the credit sold (Conservation Tax Credits, Film Tax Credits and certain Historic Rehabilitation Tax Credits). Credit Used in 2017. Potential carryover to 2018 (Line 27. 00 less Lines and ).

Total Credit Used in 2017 (sum of Line 8, Line 17 and 26) enter here and include on Form 500 or Form 500X, page 3 Line 20. Schedule 3 Page 1 500 Georgia Form (Rev. 06/22/17) Schedule 3 Part-Year Nonresident 2017 (Approved web version) YOUR SOCIAL SECURITY NUMBER DO NOT USE LINES 9 THRU 14 OF PAGES 2 and 3 FORM 500 or 500X SCHEDULE 3 COMPUTATION OF GEORGIA TAXABLE INCOME FOR ONLY PART-YEAR RESIDENTS AND NONRESIDENTS. Income earned in another state as a Georgia resident is taxable but other state(s) tax credit may apply. See IT-511 Tax Booklet. FEDERAL INCOME AFTER GEORGIA ADJUSTMENT (COLUMN A) 1. WAGES, SALARIES, TIPS, etc 2.

INTERESTS AND DIVIDENDS 3. BUSINESS INCOME OR (LOSS). 00 INCOME NOT TAXABLE TO GEORGIA (COLUMN B) 1. WAGES, SALARIES, TIPS, etc 2.

INTERESTS AND DIVIDENDS 3. BUSINESS INCOME OR (LOSS).

00 OTHER INCOME OR (LOSS) 5. TOTAL INCOME: TOTAL LINES 1 THRU 4. TOTAL ADJUSTMENTS FROM FORM 1040 8. ADJUSTED GROSS INCOME: LINE 5 PLUS OR MINUS LINES 6 AND 7 9. OTHER INCOME OR (LOSS) 5. TOTAL INCOME: TOTAL LINES 1 THRU 4. 00 or Standard Deduction INTERESTS AND DIVIDENDS.

00 BUSINESS INCOME OR (LOSS). OTHER INCOME OR (LOSS) 5. TOTAL INCOME: TOTAL LINES 1 THRU 4 7. TOTAL ADJUSTMENTS FROM FORM 500, SCHEDULE 1 8. ADJUSTED GROSS INCOME: LINE 5 PLUS OR MINUS LINES 6 AND 7 (See IT-511 Tax Booklet).

Spouse: 65 or over? Total x 1,300=. TOTAL ADJUSTMENTS FROM FORM 500, SCHEDULE 1 8. ADJUSTED GROSS INCOME: LINE 5 PLUS OR MINUS LINES 6 AND 7 9. Personal Exemption from Form 500 (See IT-511 Tax Booklet) 11a.

Enter the number on Line 6c. From Form 500 or 500X multiply by $2,700 for filing status A or D or multiply by $3,700 for filing status B or C 11b.

Enter the number on Line 7a. From Form 500 or 500X multiply by $3,000. Add Lines 11a. Enter total.

Add Lines 10a, 10b, and 11c. Total Deductions and Exemptions: 13.

Multiply Line 12 by Ratio on Line 9 and enter result. Georgia Taxable Income: Subtract Line 13 from Line 8, Column C Enter here and on Line 15, Page 3 of Form 500 or Form 500X. List the state(s) in which the income in Column B was earned and/or to which it was reported. SELECT SELECT. TOTAL ADJUSTMENTS FROM FORM 1040 10b. Additional Standard Deduction Self: 65 or over?.

00 RATIO: Divide Line 8, Column C by Line 8, Column A. Enter percentage. TOTAL ADJUSTMENTS FROM FORM 1040. 00 WAGES, SALARIES, TIPS, etc 3. TOTAL ADJUSTMENTS FROM FORM 500, SCHEDULE 1 1. GEORGIA INCOME (COLUMN C). 00% Not to exceed 100%.

00 Form Page IND-CR 201 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev. 06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201 O.C.G.A. § 48-7-29.1 provides a disabled person credit equal to the lesser of $500 per residence or the taxpayer’s income tax liability for the purchase of a new single-family home that contains all of the accessibility features listed below.

It also provides a credit equal to the lesser of the cost or $125 to retrofit an existing single-family home with one or more of these features. The disabled person must be the taxpayer or the taxpayer’s spouse if a joint return is filed. Qualified features are: One no-step entrance allowing access into the residence. Interior passage doors providing at least a 32-inch-wide opening. Cac-aphd14e20wh hdmi cable for macbook.

Reinforcements in bathroom walls allowing installation of grab bars around the toilet, tub, and shower, where such facilities are provided. Light switches and outlets placed in accessible locations. To qualify for this credit, the disabled person must be permanently disabled and have been issued a permanent parking permit by the Department of Revenue or have been issued a special permanent parking permit by the Department of Revenue. This credit can be carried forward 3 years. For more information, see Regulation 560-7-8.44.

Credit remaining from previous years. Purchase of a home that contains all four accessibility features OR total of accessibility features added to retrofit a home (up to $125 per feature) cannot exceed $500 per residence. Enter credit used in 2017 (enter here and include on IND-CR Summary Worksheet Line 1).

Potential carryover to 2018 (Line 1 plus Line 2 less Line 3). 00 Form Page IND-CR 202 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev. 06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 202 Child and Dependent Care Expense Credit - Tax Credit 202 Child and Dependent Care Expense Credit - Tax Credit 202 O.C.G.A.

§ 48-7-29.10 provides taxpayers with a credit for qualified child & dependent care expenses. The credit is a percentage of the credit claimed and allowed under Internal Revenue Code § 21 and claimed by the taxpayer on the taxpayer’s Federal income tax return. This credit cannot be carried forward. The credit is computed as follows: 1. Amount of child & dependent care expense credit claimed on Federal Form 1040.

Georgia allowable rate. Allowable Child & Dependent Care Expense Credit (Line 1 x.30). Enter credit used in 2017 (enter here and include on IND-CR Summary. Worksheet Line 2). 00 Form Page IND-CR 203 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev.

06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 203 Georgia National Guard/Air National Guard Credit - Tax Credit 203 Georgia National Guard/Air National Guard Credit - Tax Credit 203 O.C.G.A. § 48-7-29.9 provides a tax credit for Georgia residents who are members of the National Guard or Air National Guard and are on active duty full time in the United States Armed Forces, or active duty training in the United States Armed Forces for a period of more than 90 consecutive days. The credit shall be claimed and allowed in the year in which the majority of such days are served.

In the event an equal number of consecutive days are served in two calendar years, then the exclusion shall be claimed and allowed in the year in which the ninetieth day occurs. The credit shall apply with respect to each taxable year in which such member serves for such qualifying period of time. The credit cannot exceed the amount expended for qualified life insurance premiums nor the taxpayer’s income tax liability. Qualified life insurance premiums are the premiums paid for insurance coverage through the service member’s Group Life Insurance Program administered by the United States Department of Veterans Affairs.

Any unused tax credit is allowed to be carried forward to the taxpayer’s succeeding year’s tax liability. Credit remaining from previous years. Enter amount of qualified life insurance premiums. Enter credit used in 2017 (enter here and include on IND-CR Summary Worksheet Line 3). Carryover to 2018 (Line 1 plus Line 2 less Line 3). 00 Form Page IND-CR 204 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev.

06/22/17) 1 YOUR SOCIAL SECURITY NUMBER (Approved web version) – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 204 Qualified Caregiving Expense Credit - Tax Credit 204 Qualified Caregiving Expense Credit - Tax Credit 204 O.C.G.A. § 48-7-29.2 provides a qualified caregiving expense credit equal to 10 percent of the cost of qualified caregiving expenses for a qualifying family member.

The credit cannot exceed $150. Qualified services include Home health agency services, personal care services, personal care attendant services, homemaker services, adult day care, respite care, or health care equipment and other supplies which have been determined by a physician to be medically necessary. Services must be obtained from an organization or individual not related to the taxpayer or the qualifying family member. The qualifying family member must be at least age 62 or been determined disabled by the Social Security Administration. A qualifying family member includes the taxpayer or an individual who is related to the taxpayer by blood, marriage or adoption. Qualified caregiving expenses do not include expenses that were subtracted to arrive at Georgia net taxable income or for which amounts were excluded from Georgia net taxable income. There is no carryover or carry-back available.

Georgia Form 500 For Mac 2017

The credit cannot exceed the taxpayer’s income tax liability. For more information, see Regulation 560-7-8.43. Qualifying Family Member Name: Name: SS# Age, if 62 or over Relationship If disabled, date of disability Additional Qualifying Family Member Name, if applicable: Name: SS# Age, if 62 or over Relationship If disabled, date of disability 1. Qualified caregiving expenses.

Percentage limitation. Line 1 multiplied by Line 2. Maximum credit. Enter the lesser of Line 3 or Line 4.

Enter credit used in 2017 (enter here and include on IND-CR Summary Worksheet Line 4). 00 Form IND-CR 205 Page State of Georgia Individual Credit Form Georgia Department of Revenue 2017 (Rev. 06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 205 Driver Education Credit - Tax Credit 205 Driver Education Credit - Tax Credit 205 O.C.G.A.§ 48-7-29.5 provides for a driver education credit. This is a credit for an amount paid for a dependent minor child for a successfully completed course of driver education at a private driver training school licensed by the Department of Driver Services under Chapter 13 of Title 43, “The Driver Training School and Commercial Driver Training School License Act.” The amount of the credit is equal to $150 or the actual amount paid, whichever is less.

A private driver training school is one that primarily engages in offering driving instruction. This does not include schools owned or operated by local, state, or federal governments. An amount paid for a completed course of driver education to a private or public high school does not qualify for this credit. A completed course of driver education includes additional courses offered by private driver training schools such as defensive driver education. This tax credit is only allowed once for each dependent minor child of a taxpayer. The amount of the tax credit cannot exceed the taxpayer’s income tax liability.

The credit is not allowed with respect to any driver education expenses either deducted or subtracted by the taxpayer to arrive at Georgia taxable net income or with respect to any driver education expenses for which amounts were excluded from Georgia taxable net income. Any unused tax credit cannot be carried forward to any succeeding years’ tax liability and cannot be carried back to any prior years’ tax liability.

Visit dds.ga.gov/Training/index.aspx. First Child Name of private driver training school Name of dependent minor child Birth Date SS# Date of Successful Completion. Second Child, if applicable Name of private driver training school Name of dependent minor child Birth Date SS# Date of Successful Completion. Amount paid for the successfully completed course(s). Maximum credit (cannot exceed $150 per child).

Enter the lesser of Line 1 or Line 2. Enter credit used in 2017 (enter here and include on IND-CR Summary Worksheet Line 5). 00 Form Page IND-CR 206 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev.

06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 206 Disaster Assistance Credit - Tax Credit 206 Disaster Assistance Credit - Tax Credit 206 O.C.G.A.

§ 48-7-29.4 provides for a credit for a taxpayer who receives disaster assistance during a taxable year from the Georgia Emergency Management and Homeland Security Agency or the Federal Emergency Management Agency. The amount of the credit is equal to $500 or the actual amount of the disaster assistance, whichever is less. The credit cannot exceed the taxpayer’s income tax liability.

Any unused tax credit can be carried forward to the succeeding years’ tax liability but cannot be carried back to the prior years’ tax liability. The approval letter from the disaster assistance agency must be enclosed with the return. The following types of assistance qualify: Grants from the Department of Human Services’ Individual and Family Grant Program.

Grants from GEMA/HS and/or FEMA. Loans from the Small Business Administration that are due to disasters declared by the President or Governor. Disaster assistance agency 1. Credit remaining from previous years. Date assistance was received. Amount of the disaster assistance received.

Maximum credit. Enter the lesser of Line 3 or Line 4.

Enter credit used in 2017 (enter here and include in IND-CR Summary Worksheet Line 6). Carryover to 2018 (Line 1 plus Line 5 less Line 6).

00 Form Page IND-CR 207 State of Georgia Individual Credit Form Georgia Department of Revenue 2017 (Rev. 06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 207 Rural Physicians Credit - Tax Credit 207 Rural Physicians Credit - Tax Credit 207 O.C.G.A. § 48-7-29 provides for a $5,000 tax credit for rural physicians.

The tax credit may be claimed for not more than five years. There is no carryover or carry-back available. The credit cannot exceed the taxpayer’s income tax liability. In order to qualify, the physician must meet the following conditions: 1. The physician must have started working in a rural county after July 1, 1995. If the physician worked in a rural county prior to that date, a period of at least three years must have elapsed before the physician returns to work in a rural county. The physician must practice and reside in a rural county.

For taxable years beginning on or after January 1, 2003, a physician qualifies for the credit if they practice in a rural county and reside in a county contiguous to a rural county. A rural county is defined as one with 65 or fewer persons per square mile according to the United States Decennial Census of 1990 or any future such census. For taxable years beginning on or after January 1, 2012, the United States Decennial Census of 2010 is used (see regulation 560-7-8.20 for transition rules). A listing of rural counties for purposes of the rural physicians credit may be obtained at the following web page: dor.georgia.gov 3.

The physician must be licensed to practice medicine in Georgia, primarily admit patients to a rural hospital, and practice in the fields of family practice, obstetrics and gynecology, pediatrics, internal medicine, or general surgery. A rural hospital is defined as an acute-care hospital located in a rural county that contains 80 or fewer beds. For taxable years beginning on or after January 1, 2003, a rural hospital is defined as an acute-care hospital located in a rural county that contains 100 or fewer beds. For more information, see Regulation 560-7-8.20. Only enter the information for the taxpayer and/or the spouse if they are a rural physician. Taxpayer Spouse 1. County of residence 1.

County of residence 2. County of practice 2. County of practice 3. Type of practice 3. Type of practice 4. Date started working as a rural physician 4.

Date started working as a rural physician 5. Number of hospital beds in the rural hospital 5. Number of hospital beds in the rural hospital 6.

Rural physicians credit, enter $5,000 per rural physician. Enter credit used in 2017 (enter here and on IND-CR Summary Worksheet Line 7). 00 Form Page IND-CR 208 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev.

06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 208 Adoption of a Foster Child Credit - Tax Credit 208 Adoption of a Foster Child Credit - Tax Credit 208 Georgia Code Section 48-7-29.15 provides an income tax credit for the adoption of a qualified foster child. The amount of the credit is $2,000 per qualified foster child per taxable year, commencing with the year in which the adoption becomes final, and ending in the year in which the adopted child attains the age of 18. This credit applies to adoptions occurring in the taxable years beginning on or after January 1, 2008. Any unused credit can be carried forward until used. Credit remaining from previous years.

Enter $2,000 per qualified foster child. Enter credit used in 2017 (enter here and include on IND-CR Summary Worksheet Line 8). Carryover to 2018 (Line 1 plus Line 2 less Line 3).

Form Page IND-CR 209 State of Georgia Individual Credit Form Georgia Department of Revenue 2017(Rev. 06/22/17) (Approved web version) 1 YOUR SOCIAL SECURITY NUMBER – Enclose with Form 500 or 500X, if this schedule is applicable. – SCHEDULE 209 Eligible Single-Family Residence Tax Credit - Tax Credit 209 Eligible Single-Family Residence Tax Credit - Tax Credit 209 O.C.G.A.

§ 48-7-29.17 provides taxpayers a credit for the purchase of an eligible single-family residence located in Georgia. Form 500 is the general income tax return form for all Georgia residents. Form 500 requires you to list multiple forms of income, such as wages, interest,. We last updated the Individual Income Tax Returns in January 2018, so this is the latest version of Form 500, fully updated for tax year 2017. You can download or print current or of Form 500 directly from TaxFormFinder. You can print other.

Other Georgia Individual Income Tax Forms: TaxFormFinder has an additional that you may need, plus all. Form Code Form Name Form 500 Form 500-EZ Tax Return Form 500-ES Estimated Form IT-511 Form IT-560 Extension Form Sources: Georgia usually releases forms for the current tax year between January and April. We last updated Georgia Form 500 from the Department of Revenue in January 2018. Original Form PDF is.

Georgia Form 500 For Mac Download

Georgia Income Tax Forms at. Georgia Department of Revenue at. About the Individual Income Tax The IRS and most states collect a personal income tax, which is paid throughout the year via tax withholding or estimated income tax payments. Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their state's revenue department, which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayer's entire liability. Every taxpayer's situation is different - please consult a CPA or licensed tax preparer to ensure that you are filing the correct tax forms! Historical Past-Year Versions of Georgia Form 500.